Best Apps and Tools for Freelancers in 2025: Grow Your Freelance Business

The freelance economy has exploded. With over 73 million Americans freelancing and the global market valued at $1.5 trillion, the competition for high-paying clients has never been fiercer. Yet most freelancers still struggle with the same problems: tracking billable hours, managing invoices, organizing finances, and scaling beyond trading time for money.

Here’s the reality: freelancers using the right tech stack earn 23% more than those relying on spreadsheets and manual processes. The difference between a $50K freelancer and a $150K consultant often comes down to systems, not skills. The best apps for freelancers don’t just save time—they directly increase your earning potential by optimizing every aspect of your business operations.

This guide breaks down the best tools for freelancers that will transform your solo operation into a profitable business machine in 2025. We’re not talking about generic productivity apps. These are revenue-generating systems that help you bill more hours, close bigger deals, and build recurring income streams.

Why Freelancers Need the Right Tools for Income Growth

The Hidden Cost of Manual Processes

The math is simple. If you’re spending 40% of your time on admin tasks, you’re losing 40% of potential billable hours. That’s $40,000 annually for a freelancer billing $100/hour. Manual processes don’t just waste time—they actively destroy revenue.

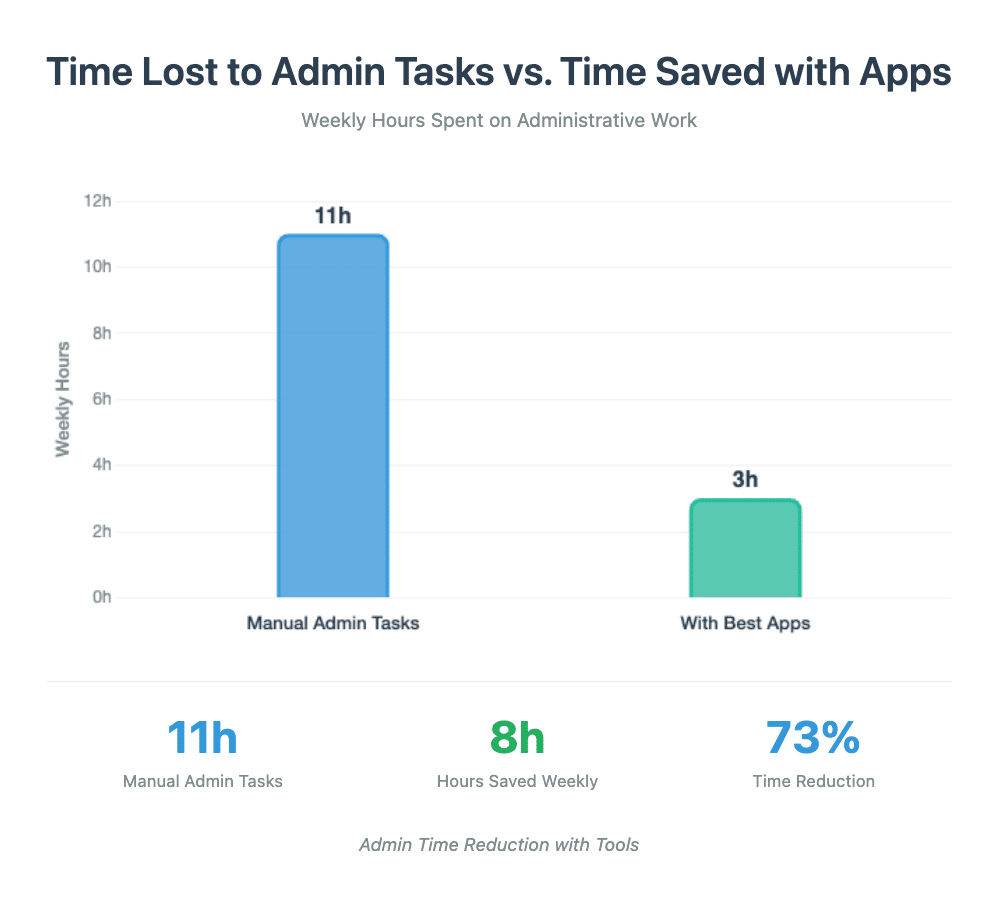

Every spreadsheet update, every manual invoice, every email search for client information represents lost income. The average freelancer spends 11 hours weekly on non-billable admin work. Professional freelance tools cut this to under 3 hours, recovering a full workday for revenue generation.

Time Saved with the Best Apps for Freelancers

The opportunity cost compounds over time. While you’re formatting invoices, competitors using the best apps for freelancers and automated systems are landing new clients. While you’re calculating taxes, they’re developing new service offerings. The gap widens daily.

ROI of Professional Freelance Tools

Investment in the right software stack typically returns 10-20x within the first year. A $50/month tool that saves 5 hours monthly at $100/hour pays for itself 10 times over. But the real returns come from compound benefits.

Professional tools don’t just save time—they increase rates, and some of the best apps for freelancers directly help justify higher pricing. Freelancers with polished proposals and automated follow-ups command 30% higher fees. Clean financial reports justify premium pricing. Systematic client management enables value-based pricing over hourly billing.

The credibility boost alone justifies the investment. Clients choose freelancers who demonstrate professionalism through their operations. Modern invoicing, seamless onboarding, and organized project management signal that you’re truly running a business, not just a side hustle.

Three Critical Problems That Kill Freelance Income

Time leakage costs the average freelancer 8-12 hours weekly. Without proper time tracking, you’re undercharging clients and leaving money on the table. Studies show freelancers using time tracker for freelancers bill 15-20% more hours simply by capturing previously lost work.

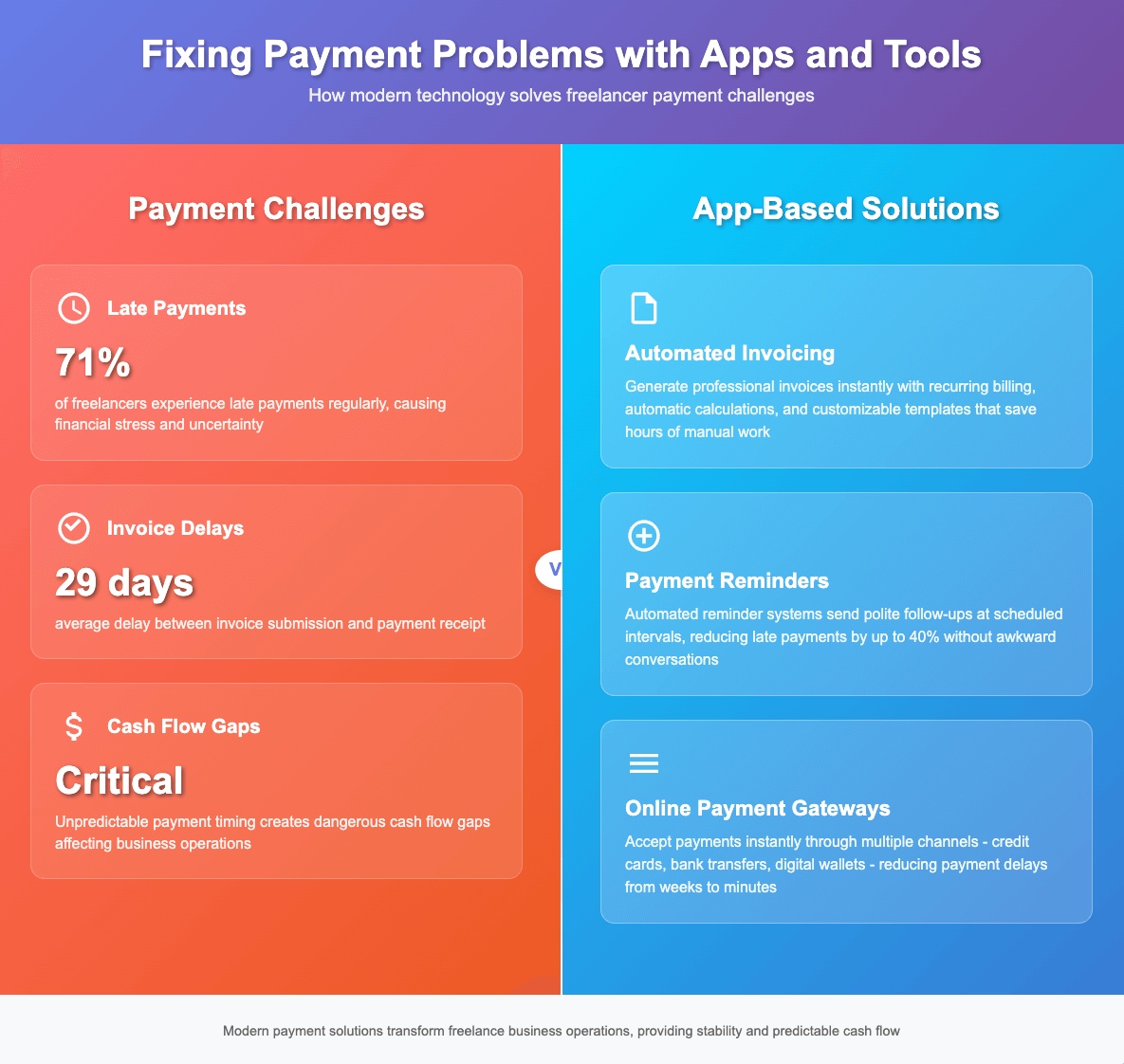

Cash flow gaps kill freelance businesses. Late payments affect 71% of freelancers, with the average invoice paid 29 days late. Professional freelance invoicing software with automated follow-ups reduces payment delays by 60%, fundamentally changing your financial stability.

Client relationship chaos limits growth potential. Freelancers managing clients only through their inbox lose 23% of potential repeat business. A proper CRM for freelancers increases client lifetime value by 47% through better relationship management and systematic upselling opportunities.

Best Apps for Freelancers (2025 Overview)

Essential Tool Categories for Revenue Growth

The freelance tool landscape has evolved dramatically. Today’s best freelance apps fall into four critical categories that directly impact income.

Financial Management Stack combines invoicing, expense tracking, tax preparation, and financial forecasting. Tools like FreshBooks and QuickBooks Self-Employed handle the entire financial lifecycle from proposal to tax filing. This category forms your business foundation.

Client Operations System integrates CRM, project management, and communication tools. Platforms like HoneyBook and Dubsado create seamless client experiences while automating repetitive tasks. These systems turn one-time projects into long-term relationships.

Revenue Optimization Tools include time tracking, proposal builders, and contract management systems that directly increase billable hours and project values. Harvest and Toggl Track lead this category with AI-powered insights that reveal hidden revenue opportunities.

Growth Acceleration Platforms encompass marketing automation, lead generation, newsletter systems, SEO tools, and portfolio management solutions that build your pipeline while you work on client projects. These tools create passive income streams and reduce feast-or-famine cycles.

Integration vs. Individual Tools

The integration debate misses the point. Success requires both integrated suites and best-in-class individual tools. The key is ensuring seamless data flow between platforms.

All-in-one solutions like Bonsai or HoneyBook simplify operations with unified interfaces, keeping everything in one place and reducing context switching and data entry. However, these platforms rarely excel at everything. The invoicing might be good but time tracking mediocre.

Best-of-breed approaches combine specialized tools through integrations. Toggl Track for time tracking, FreshBooks for invoicing, and HubSpot for CRM. Each tool excels at its core function, making it easier to choose the exact service you need for your freelance business. Zapier, Google Drive, or native integrations connect them into automated workflows.

The optimal approach: start with an integrated suite to establish baseline operations, then replace weak components with specialized tools as you identify specific needs.

Budget Allocation for Your Tech Stack

Successful freelancers invest 2-5% of gross revenue in business apps and software, prioritizing the best apps for freelancers that deliver measurable ROI. For someone earning $5,000 monthly, that’s $100-250 for your tech stack. This investment should generate minimum 10x returns through efficiency gains.

Priority spending order:

- Accounting/Invoicing ($30-50/month) – immediate ROI through faster payments

- Time Tracking ($10-30/month) – captures lost billable hours

- CRM System ($0-50/month) – increases client lifetime value

- Project management tools ($10-40/month) – improve delivery efficiency

- Marketing Tools ($20-100/month) – generates new opportunities

Track ROI religiously. If a tool doesn’t pay for itself within 90 days, replace it. The exception is accounting software for freelancers, which pays dividends at tax time regardless of immediate returns.

Time Tracker for Freelancers – Boost Your Billable Hours

Toggl Track – AI-Powered Time Intelligence

Toggl Track dominates the time tracking space with its one-click timer and automatic time detection. The platform’s AI identifies patterns in your work, suggesting when you’re undercharging for specific tasks. Users report billing 18% more hours within the first month.

The real power comes from data insights. Toggl’s reports show exactly which clients and projects generate the highest hourly rates. This intelligence lets you focus on profitable work while phasing out low-margin projects. The platform integrates with 100+ different tools, automatically tracking time across various applications.

The timeline feature reconstructs your day using computer activity, catching forgotten time entries. Background tracking ensures nothing slips through the cracks. Mobile apps continue tracking during client meetings or off-site work, ensuring every minute of meeting time is accurately captured.

Harvest – Time Tracking Meets Invoicing

Harvest takes an integrated approach, combining time tracking with invoicing and expense management. This integration means billable hours flow directly into invoices, eliminating data entry and reducing billing errors by 90%.

The forecasting feature predicts future revenue based on current time tracking patterns. See exactly when projects will end and revenue will drop, giving you lead time to secure new work. Capacity planning shows team utilization for agencies scaling beyond solo operations.

Harvest’s best invoice software for freelancers capabilities include automated payment reminders, online payment acceptance, and recurring invoices. The seamless flow from time entry to paid invoice typically accelerates cash flow by 2-3 weeks.

Free Options That Actually Work

For freelancers seeking a free time tracking app for freelancers, Clockify offers unlimited tracking for unlimited users. While it lacks advanced features, the core functionality handles basic time capture effectively. The paid plan adds profit calculations and billable rates.

RescueTime operates differently, automatically categorizing computer usage into productive and unproductive time. This passive tracking reveals where you’re losing focus, helping eliminate distractions. Users typically recover 5-7 hours of productive time weekly.

Toggl Track’s free plan supports up to 5 users with basic reporting. It’s sufficient for solo freelancers who need simple time tracking without advanced analytics. Upgrade when you need detailed profitability reports or team features.

Key Metrics for Time Tracking Success

The metrics that matter go beyond hours logged. Track utilization rate—billable hours divided by total work hours. Top earners maintain 70-80% utilization. Below 60% indicates too much admin time or inefficient workflows.

Monitor effective hourly rate by project type. Your design work might yield $150/hour while writing generates $75/hour. This data drives strategic decisions about service offerings and pricing structures.

Average project overrun reveals scope creep patterns. If projects consistently exceed estimates by 20%, you’re either underestimating or failing to manage scope. Time tracking data provides evidence for change orders and additional invoices.

Self Employed Accounting Software – Stay Profitable & Organized

QuickBooks Self-Employed – The Tax Optimization Machine

QuickBooks Self-Employed remains the gold standard for solo operators. The platform automatically categorizes expenses, tracks mileage via GPS, and calculates quarterly taxes in real-time. Users save an average of $4,340 annually in previously missed deductions.

The receipt capture feature alone recovers hundreds in forgotten expenses monthly, making it easier to manage your freelance finances without missing deductions. Snap a photo, and AI extracts vendor, amount, and category. The mileage tracker runs continuously, automatically detecting and logging business trips. No more mileage logs or forgotten deductions.

Tax optimization goes beyond basic categorization, and freelancers can also reference the IRS Self-Employed Tax Center for compliance and deduction guidance. The software identifies industry-specific deductions, estimates quarterly payments to avoid penalties, and exports everything your accountant needs. The peace of mind knowing you’re tax-compliant is worth the subscription alone.

FreshBooks – Simplicity Meets Power

FreshBooks approaches self employed accounting software from a user experience angle, prioritizing ease over complexity. Double-entry accounting happens behind the scenes while you work with intuitive interfaces.

Automated expense tracking pulls data from bank accounts and credit cards, categorizing transactions with 95% accuracy. Rules-based automation learns your patterns, improving categorization over time. Expense reports generate themselves for client reimbursements.

The platform’s profitability tracking shows real-time margins on every project. See which clients actually make you money after expenses. This visibility leads to better pricing decisions and client selection, typically increasing profit margins by 15-20%.

Wave and Xero – Alternative Approaches

Wave offers professional-grade bookkeeping software for freelancers completely free, designed to help you manage invoices, expenses, and financial reports without added costs.. For freelancers just starting out, it provides everything needed to maintain clean books without monthly overhead.

The platform handles unlimited invoicing, expense tracking, and financial reporting. Receipt scanning, bank connections, and basic reports rival paid alternatives. The trade-off is fewer automations and limited customer support.

Xero excels at multi-currency support and advanced reporting, perfect for international freelancers. Real-time bank feeds, automatic reconciliation, and cash flow forecasting predict account balances 30 days out. The learning curve is steeper, but capabilities exceed simpler alternatives.

Choosing Based on Your Revenue Level

Under $30K annually: Start with Wave. Free tools provide sufficient functionality while you establish your business. Focus spending on revenue-generating tools rather than back-office software.

$30K-$75K: Upgrade to FreshBooks or QuickBooks Self-Employed. The automation and tax features pay for themselves through time savings and deduction discovery. Professional invoicing alone justifies the cost.

$75K+: Consider Xero or QuickBooks Online. Advanced reporting, multi-currency support, and scalability become critical. The ability to add team members and accountant access enables growth beyond solo operations.

Freelance Invoicing Software – Get Paid Faster

FreshBooks – Payment Acceleration Features

FreshBooks leads the invoicing category with features like automated payment reminders and instant payment options, specifically designed to accelerate payments. Automated payment reminders reduce late payments by 60%, while instant payment options get you paid 11 days faster on average.

The software tracks invoice views in real-time, alerting you when clients open bills. This intelligence enables perfectly timed follow-ups that dramatically improve collection rates. Know exactly who’s seen invoices and who needs nudging.

Recurring invoices automate billing for retainer clients. Set up once, bill forever. Automatic credit card charging ensures payment without client action. This feature alone can stabilize cash flow for service businesses.

Invoice Ninja and AND CO – Specialized Solutions

Invoice Ninja offers enterprise-level freelance invoicing software capabilities at freelancer-friendly prices. Support for multiple currencies, languages, and payment gateways makes it perfect for international freelancers.

The client portal revolutionizes the billing experience. Customers view all invoices, make payments, and approve quotes in one place. This self-service approach reduces back-and-forth communication by 70% while improving client satisfaction.

AND CO (now part of Fiverr) combines invoicing with complete business management. Beyond standard billing, it handles contracts, proposals, and expense tracking. The time-to-invoice feature automatically generates bills from tracked hours, reducing billing time to under 60 seconds.

Bonsai – Creative Freelancer Focus

Bonsai specializes in creative freelancers with industry-specific templates and payment terms, making it especially useful for those in fields like graphic design, writing, and consulting. The platform understands that designers, writers, and consultants have unique billing needs.

Scope creep protection automatically flags project overages, prompting additional invoices before work continues. Users report 25% higher project values through better scope management. The system prevents the awkward “surprise” invoice that damages client relationships.

Contract templates protect your interests while accelerating deal closure. Integrated e-signatures mean proposals become contracts become invoices in one seamless flow. This integration reduces sales cycle time by 40%.

Payment Strategies That Work

Net 15 terms with 2% early payment discounts drive immediate payments. Clients save money while you improve cash flow. Win-win pricing psychology beats demanding immediate payment.

Partial upfront payments (25-50%) fundamentally change cash flow dynamics. You’re no longer financing client projects with your own money. This single change often eliminates cash flow problems entirely.

Automated late fees create urgency without awkward conversations. Clear terms established upfront mean the system handles enforcement. 1.5% monthly late fees are standard and legally enforceable in most jurisdictions.

CRM for Freelancers – Manage Clients Like a Pro

HubSpot CRM – Free Powerhouse

HubSpot’s free CRM offers capabilities that rival enterprise systems. Every client interaction tracks automatically, building detailed contact histories without manual data entry. Email tracking shows when prospects open proposals, triggering perfectly timed follow-ups.

The deal pipeline visualizes your entire business development process. Drag deals through stages from initial contact to signed contract. This visibility reveals bottlenecks—most freelancers discover they’re losing deals at the proposal stage, not initial pitch.

Email templates and sequences automate outreach while maintaining personalization. Send follow-ups automatically based on prospect behavior. If someone opens your proposal three times without responding, the system triggers a check-in email.

Dubsado – Complete Workflow Automation

Dubsado builds complete client management workflows tailored for service providers. From first inquiry through project completion, every step automates. The platform sends contracts, collects payments, schedules appointments, and manages projects autonomously.

The workflow builder uses visual programming to create complex automations without code. When prospects fill out your contact form, Dubsado sends pricing, schedules discovery calls via Google Calendar, and creates projects automatically. Users save 10+ hours weekly on client administration.

Client portals provide white-labeled spaces for all client interactions. Customers access contracts, invoices, project files, and communication in one branded location. This professional experience justifies premium pricing.

Folk and Monday.com – Modern Alternatives

Folk reimagines CRM for freelancers with relationship intelligence over data entry. The platform automatically enriches contacts with social media profiles, company information, and mutual connections. This context helps personalize outreach and identify opportunities.

The Chrome extension captures contacts from anywhere—LinkedIn, email, websites. One click adds complete profiles to your CRM. No more manual data entry or incomplete records. The system maintains itself through intelligent automation and regular updates, ensuring your client data stays accurate and reliable.

Monday.com adapts its project management app into a lightweight CRM. Visual boards make pipeline management intuitive. Automation handles repetitive tasks like follow-up emails and status updates, making task management far more efficient.. The mobile app keeps you connected anywhere.

Critical CRM Metrics to Track

Pipeline velocity measures how fast deals move through stages. If proposals sit for weeks, you need better follow-up processes. Fast-moving pipelines indicate healthy sales processes and qualified prospects.

Conversion rate by source reveals which channels bring quality clients. Your LinkedIn outreach might convert at 20% while cold emails convert at 2%. This data drives marketing investment decisions.

Client lifetime value determines retention focus. If clients average $10,000 over their lifetime, spending $500 to acquire them makes sense. Track revenue per client relationship to optimize acquisition costs.

Bookkeeping & Financial Planning Tools for Freelancers

Bench – Done-For-You Bookkeeping

Bench combines software with human bookkeepers, delivering done-for-you books monthly. This hybrid approach ensures accuracy while freeing you from financial admin entirely. Professional bookkeepers categorize transactions, reconcile accounts, and prepare reports.

Monthly financial packages include P&L statements, balance sheets, and cash flow reports in plain English, helping freelancers stay on top of their business finances. No accounting degree required to understand your finances. Visual dashboards show trends and patterns at a glance.

The platform identifies tax-saving opportunities throughout the year, not just at tax time. Bookkeepers flag unusual expenses, suggest deductions, and ensure compliance. Users typically find $3,000+ in missed deductions their first year.

Cash Flow Forecasting Tools

Pocketsmith focuses on cash flow forecasting, projecting your financial position months ahead. The platform learns income and expense patterns, predicting exactly when you’ll hit goals or face shortfalls.

Scenario planning lets you model different futures. What if you land that big client? What if you raise rates 20%? See the impact before making decisions. This foresight enables strategic choices rather than reactive scrambling.

Float extends cash flow forecasting with invoice intelligence. By connecting to your invoicing software, it predicts payment timing based on historical client behavior. Know exactly when money will hit your account, not just when it’s due.

Tax Optimization Software

Keeper Tax automates expense tracking through bank transaction analysis. AI identifies tax deductions with 90% accuracy, finding write-offs you’d never think to claim. The platform tracks industry-specific deductions for your freelance niche.

The mileage tracker runs continuously, automatically detecting business trips. No manual logging required. The app learns your patterns, distinguishing between personal and business travel with increasing accuracy.

FlyFin combines AI categorization with CPA review. The software handles basic categorization while CPAs verify accuracy and maximize deductions. This hybrid approach costs less than traditional bookkeepers while delivering professional results.

Building Your Financial Dashboard

Your financial dashboard should display five critical metrics: cash position, monthly burn rate, revenue pipeline, profit margins, and tax reserves. Modern best accounting software for freelancers provides these insights automatically.

Cash position shows survival runway. If you have $10,000 saved and burn $3,000 monthly, you have 3.3 months runway. This metric drives pricing and sales urgency decisions.

Revenue pipeline predicts future cash position. Outstanding invoices plus contracted work equals near-term revenue. This visibility prevents cash crunches before they occur.

How to Choose the Right Freelance Tools for Your Growth

Identifying Your Biggest Constraint

Tool selection starts with constraint analysis, helping you find the right solutions for what’s limiting your growth. Lost billable hours require time tracking solutions. Payment delays demand better invoicing. Client chaos needs CRM implementation.

Use the theory of constraints approach. Fix your biggest bottleneck completely before addressing secondary issues. A marginal improvement to your core constraint delivers more impact than optimizing non-critical processes.

Track where time goes for one week. Categorize every 15-minute block. The biggest non-billable category reveals your primary constraint. Most freelancers discover they’re losing 30-40% of potential billable time to fixable inefficiencies.

Calculating True ROI

ROI calculation must include all benefits, not just time savings. A $50/month tool needs to generate $500+ monthly through combined time savings, revenue increase, and cost reduction.

Time savings multiply your hourly rate. Five hours saved monthly at $100/hour equals $500 value. But also consider revenue acceleration. Getting paid 10 days faster improves cash flow value by 2-3% monthly.

Soft benefits matter too. Reduced stress, improved client satisfaction, and professional credibility have real value. While harder to quantify, these factors often determine long-term success.

Integration Requirements

Tools that don’t communicate create data silos and duplicate work. Your core stack should share information seamlessly. Time entries should flow to invoices. Invoices should update accounting. Accounting should inform tax planning.

Native integrations outperform third-party connections. While Zapier enables any connection, native integrations are faster, more reliable, and include deeper functionality to help you stay organized and efficient. Prioritize tools with robust API ecosystems.

Test integrations during trial periods. Move real data between systems. Verify that automations trigger correctly. Integration failures discovered after purchase create expensive switching costs, which is why choosing the best apps for freelancers with strong native integrations is essential.

Growth Stage Considerations

Starting freelancers need simple, affordable solutions that handle basics well, and the best apps for freelancers offer free trials to make the decision easier. Complexity kills execution. Choose tools you’ll actually use over feature-rich platforms that overwhelm.

Established consultants require sophisticated platforms that scale. Multi-currency support, team capabilities, and advanced reporting become critical. Don’t let consumer apps limit growth.

Plan for next-stage requirements. If you’re solo today but plan to build an agency, choose tools that support multiple users. Switching costs—both financial and operational—make platform changes painful, especially when many tools are already connected to your workflow.

Monetization & Growth Strategy – Putting It All Together

Phase 1: Foundation (Months 1-3)

Implement core financial tools first. Get time tracking operational with Toggl or Harvest. Establish professional invoicing through FreshBooks or Wave. Organize basic bookkeeping with QuickBooks Self-Employed.

This foundation typically increases revenue 15-20% through better billing capture and faster payments, showing how the right tools will help freelancers grow faster. Focus on accuracy over optimization. Build habits around consistent time tracking and weekly financial review.

Set up basic automation. Time entries should create invoice line items. Expenses should categorize automatically. Reports should generate weekly. These simple automations save you time, typically 5+ hours monthly right from the start.

Phase 2: Optimization (Months 4-6)

Analyze data from your foundation tools. Identify true hourly rates across different clients and projects. You’ll likely discover shocking disparities—some clients generate $200/hour while others yield $50/hour for similar work.

Eliminate unprofitable work systematically. Raise rates on high-value services. Restructure engagements for better margins. This optimization phase often doubles effective hourly rates without adding hours.

Implement advanced features. Set up recurring invoices for retainer clients. Create time tracking projects with budgets. Build expense rules for automatic categorization. These optimizations compound efficiency gains.

Phase 3: Automation (Months 7-9)

Connect tools into automated workflows. Time entries become invoices automatically. Proposals trigger project creation. Payment confirms task activation. This automation recovers 10-15 hours weekly for billable work.

Build template libraries. Proposal templates, email sequences, project templates, and invoice templates eliminate repetitive creation. Standardization improves quality while reducing effort.

Create systematic processes. Document your workflows from lead to payment. Identify manual steps for automation. Each eliminated touchpoint reduces errors and accelerates delivery.

Phase 4: Scale (Months 10-12)

Leverage systematized operations for growth. Use CRM data to identify expansion opportunities within existing clients. Deploy marketing automation to generate passive leads. Create productized services that sell themselves.

Well-executed systems enable 3-5x revenue growth without proportional effort increase. Your tools handle operations while you focus on strategy and delivery. This operational leverage distinguishes six-figure freelancers.

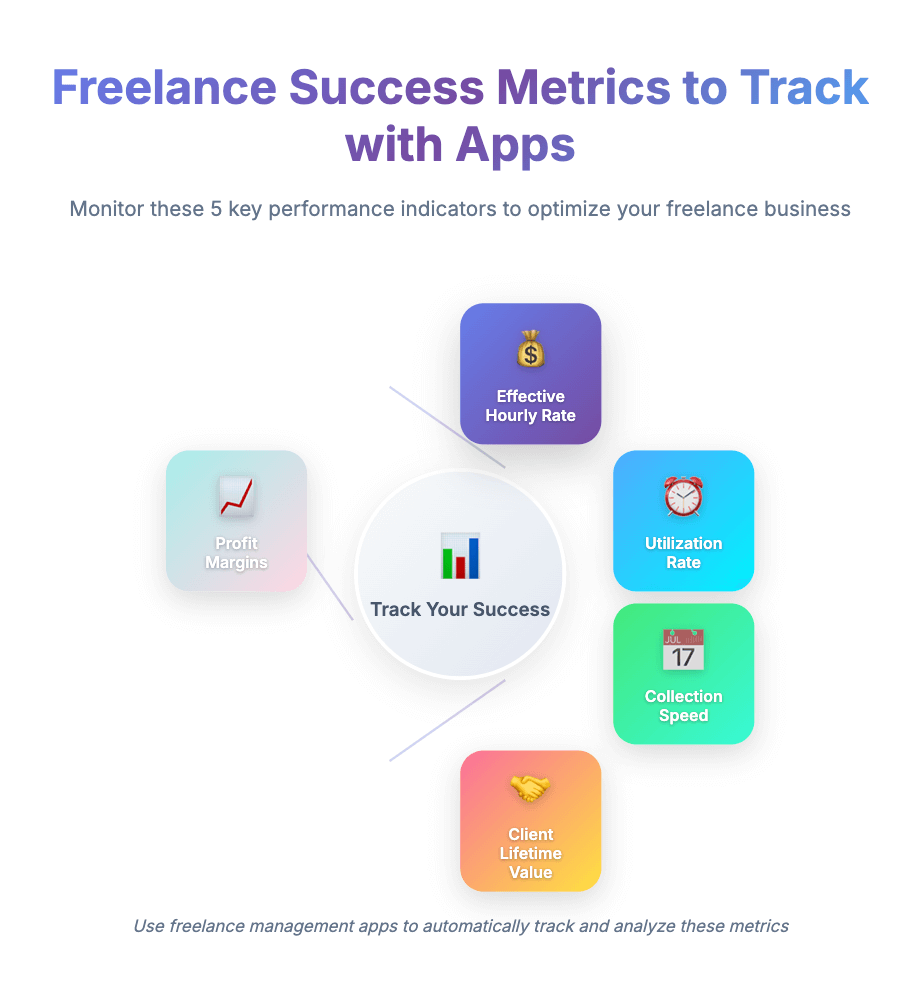

Measure everything. Track effective hourly rate, utilization rate, collection speed, and client lifetime value. Use data to drive decisions. Replace underperforming tools immediately.

Tracking Success Metrics

Monitor five key performance indicators monthly. Effective hourly rate (total revenue divided by total hours) reveals true productivity. Target $150+ for established freelancers.

Utilization rate (billable hours divided by total work hours) indicates efficiency. Maintain 70-80% for optimal performance. Below 60% suggests too much admin overhead.

Collection speed (average days to payment) impacts cash flow. Professional tools should bring this under 15 days. Anything over 30 days indicates invoicing or follow-up problems.

FAQ

What’s the minimum tech stack needed to start freelancing professionally?

You need three essential apps and tools to operate professionally: time tracking software (Toggl Track or Clockify), invoicing solution (FreshBooks or Wave), and basic accounting software for freelancers (QuickBooks Self-Employed or Wave). This foundation costs $30-50 monthly but typically generates $2,000+ in additional revenue through better billing and tax savings. Start here, then expand based on specific pain points. Don’t overcomplicate early operations—master these basics before adding complexity.

How much should I budget for freelance tools as a percentage of revenue?

Successful freelancers invest 2-5% of gross revenue in tools and software. For someone earning $5,000 monthly, that’s $100-250 for your tech stack, and most professional plans start within this range. This investment should generate 10x returns through efficiency gains and revenue optimization. Track ROI religiously—if a tool doesn’t pay for itself within 90 days, cut it. The exception is bookkeeping software for freelancers, which pays dividends at tax time regardless of immediate ROI. As revenue grows, maintain the percentage but upgrade to more powerful platforms.

Should I use free tools or invest in paid solutions from the start?

Start with free trials of professional tools rather than permanently free alternatives. Free tools often lack critical features, integrations, or support that directly impact revenue. Use the trial period to generate enough revenue to cover the subscription. If you can’t afford $50/month for professional tools, you’re undercharging clients. That said, Wave (accounting) and HubSpot CRM (client management) offer robust free tiers suitable for beginners. The key is choosing free tools that won’t require painful migrations later.

How do I migrate from spreadsheets to professional freelance tools without losing data?

Most professional platforms offer CSV import capabilities and migration support. Start by exporting your spreadsheet data in CSV format. Clean the data first—remove duplicates, standardize formats, fix inconsistencies. Begin migration with historical data from the past 90 days only; older data rarely provides value. Run parallel systems for one month to ensure accuracy. Schedule migration during slow periods to minimize business disruption. Many platforms offer free migration assistance for annual plans—take advantage of this support.

Which tools work best for freelancers with international clients?

International clients often struggle to find the right freelancer, which is why multi-currency support and global payment options are essential. Xero handles multiple currencies natively with real-time exchange rates. Wise (formerly TransferWise) integrates with most invoicing platforms for low-cost international transfers. PayPal and Stripe process international payments but charge higher fees (2.9-4.4%). Time zones become critical—Toggl Track and Harvest handle global time tracking seamlessly, especially when integrated with popular calendar apps. Always invoice in your client’s currency to reduce payment friction. Consider time zone displays in all communication to prevent scheduling confusion.

Can these tools help me transition from freelancing to building an agency?

Absolutely. The same best apps for freelancers that optimize solo operations scale into agency infrastructure. HubSpot CRM grows from managing your clients to tracking your team’s entire pipeline. FreshBooks and QuickBooks support multiple users and permission levels. Harvest enables team time tracking with individual rates. The key is choosing tools with growth potential from the start. Avoid consumer-grade solutions that require painful migrations later. Build scalable systems now, even if you’re not ready to scale yet. When growth opportunity arrives, your operations won’t be the bottleneck.

Conclusion – Your Freelance Income Growth Toolkit for 2025

The gap between struggling freelancers and six-figure consultants isn’t talent—it’s systems. The best apps for freelancerstransform chaotic solo operations into professional service businesses. Every tool in this guide directly impacts your bottom line through increased efficiency, better client management, or improved financial control.

Your next steps are clear. Choose one critical pain point—lost billable time, slow payments, or client chaos. Select the corresponding tool from this guide. Implement it completely before adding complexity. Track the impact on your revenue. Reinvest gains into additional tools that compound your effectiveness.

The freelance landscape in 2025 rewards systematic operators over lone wolves, showing that the best freelancer is the one who builds strong systems and processes. Manual processes can’t compete with automated workflows. Spreadsheets can’t match professional software. Email threads can’t replace proper CRM systems. The question isn’t whether to adopt these freelance tools, but how quickly you can implement them.

Remember: every day without proper tools costs you money. Time leaks through untracked hours. Revenue disappears through missed deductions. Growth stalls through poor client management. The investment in professional software pays for itself within weeks, especially when you select the best apps for freelancers that align with your growth goals.

Stop trading time for money. Start building systems that generate revenue while you sleep. The tools exist. The strategies work. The only variable is your execution.

Ready to accelerate your freelance income with the right tools and strategies? Join our FreelanceBoosters community on Telegram where successful freelancers share their tech stacks, automation workflows, and growth tactics. Your six-figure freelance business starts with the right foundation—build yours today.